The top 10 crypto VC funds

The top 10 crypto hedge funds

April 26, 2019

The top 10 Asian crypto hedge funds

April 26, 2019The top 10 crypto VC funds

Venture capital firms have been investing in blockchain for over a decade, but it’s really in the last two years that VC interest in the space has taken off.

Early enthusiasts like Node Capital made their first coin investments in 2011. Then things went quiet until 2013 when nearly two dozen VC funds added blockchain startups to their portfolios. Last year there were over 200 venture capital investments in blockchain and cryptocurrency companies – more than 2011 to 2015 combined.

Seemingly unfazed by the crypto bear market the number of venture deals been rising and so has their size. Ripple was one of the first cryptocurrency companies to attract VC interest back in 2012, raising $3.1 million across three funding rounds. Last year Robinhood, a stock and cryptocurrency trading platform, raised $363 million in a single series D round. In 2015 it raised $50 million in total.

There are essentially two types of Crypto VC:

1. Crypto-Focused VCs

This type of VC is dedicated exclusively to cryptocurrency and blockchain. The top three are Blockchain Capital Pantera Capital, and Digital Currency Group, which has made more than 60 seed-stage blockchain investments since it launched in 2013.

2. Traditional Tech VCs

Traditional venture funds specialize in technology startups. For most, blockchain investments remain a small percentage of their investments but a few have expanded their blockchain portfolios. These include two of the biggest, multi-billion dollar venture funds Andreessen Horowitz and Sequoia Capital.

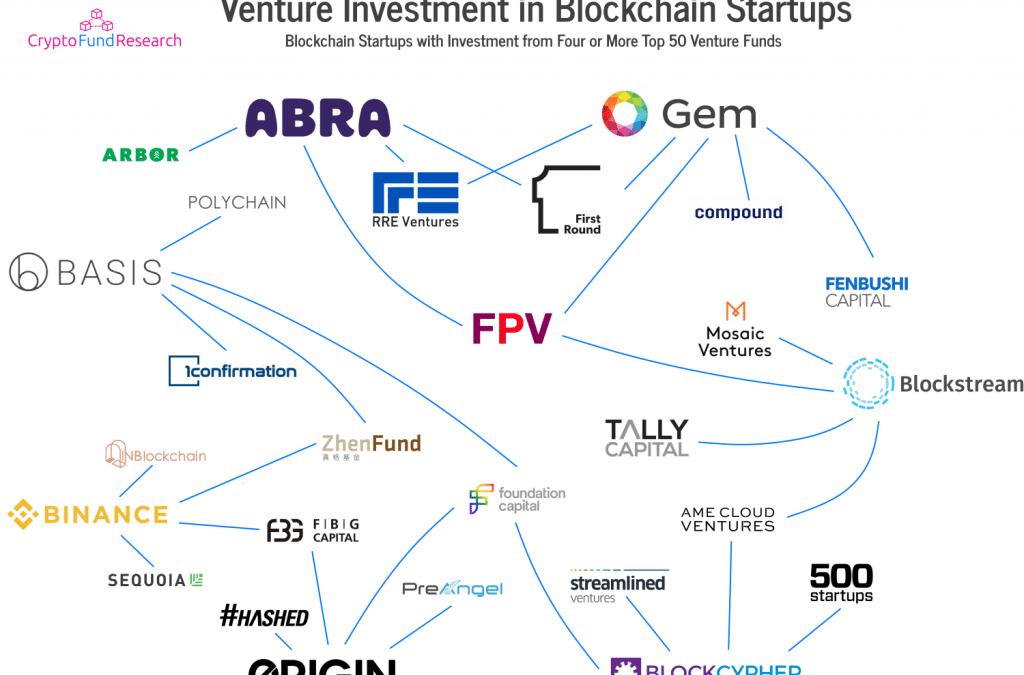

While there are more than 120 VC funds actively investing in blockchain, a handful of these play an outsized role. Here are some of the leading firms:

Andreessen Horowitz

With close to $3 billion in assets, Andreessen Horowitz or a16z is one of the world’s largest venture funds. While blockchain and crypto remain a small portion of its overall portfolio, the recent decision to launch a dedicated fund for digital assets puts them in pole position to be the most influential VC in the space.

Blockchain Capital

Another venture fund investing exclusively in blockchain and crypto, Blockchain Capital claims to be the first VC fund dedicated to the space. It made its first crypto investments in 2013 and now has a portfolio of more than three dozen blockchain companies. Most recently they took part in a $35 million series D funding round for digital asset merchant bank High Flyer.

Boost VC

More an accelerator than a traditional venture firm, Boost has made dozens of smallish investments in companies like Coinbase, Ledger, and Libra Credit Network. The firm was co-founded by Adam Draper, son of legendary VC and blockchain evangelist Tim Draper (see Draper Associates below).

Ceyuan Ventures

Beijing- and Hong Kong-based Ceyuan Ventures is an early stage venture capital company and primarily invests in Asian crypto and blockchain startups. While not quite as active in Crypto as fellow Beijing VC Node Capital (see below), they have made significant blockchain investments including OkCoin, Basis, and BlockSeer.

Digital Currency Group

As an early entrant, Digital Currency Group has been influencing blockchain investments since 2013. Starting with a sub-1 million USD position in crypto payment processor BitPay, they’ve gone on to invest over $100 million in dozens of crypto and blockchain startups – including early bets in two of crypto’s biggest success stories, Coinbase and Ripple.

Draper Associates

Draper Associates is the early stage venture capital arm of Silicon Valley legend Tim Draper’s group of companies. Draper made international headlines in 2014 when he purchased the Bitcoin seized from darknet marketplace Silk Road. He has since become one of blockchain’s leading evangelists with numerous crypto companies in his firm’s portfolio.

IDG Capital

IDG Capital is a multi-billion dollar traditional VC firm with investments in a wide range of technology startups. Its blockchain and crypto portfolio includes both angel and seed stage investments in Ripple, while it has since taken positions in Mars Financial and Circle.

Node Capital

Based in Beijing, Node Capital focuses much of its blockchain investment activity on companies in Asia like Trip.io and Houbi. Node differentiates itself from other funds by emphasising investment in ICOs rather than seed or early-stage funding.

Pantera Capital

Billing itself as an investment firm and hedge fund, much of Pantera’s portfolio involves venture-style seed funding. They invest exclusively in blockchain and cryptocurrency companies, and were an early investor in Ripple. They’ve since made over 30 venture investments in the space and invested in several initial coin offerings (ICOs).

Techstars

Colorado-based Techstars is a technology accelerator offering seed and early stage capital to blockchain and crypto startups. Their entry into blockchain investing began with a seed round investment in Chroma in 2013.

Though they have different strategies, operating procedures, and setups, each of the companies on this list is influencing the funding the development of cryptocurrencies around the globe. Given the pace of change in blockchain however, in a year the list could look very different.